I have one elder brother. My brothers' name is Jungwook Kim, who was born February, 12, 1969. He was born in New York city, U.S, the first son of my parents. My mom said that it was a cold winter snow day when he was born. The snow was 58 centimeters deep in New York's Central Park. My parents gave my brother the nickname 'Joe' because of his Christian name is Joseph. When I was a kid, I wanted to be my brother's hometown. Big Apple is my favorite city in the world, which is the largest city in the United States, is known for its history as a gateway for immigration to the United States and its status as a financial, cultural, transportation, and manufacturing center. When I was a child, I longed for the modern NY lifestyle. Listen to Frank Sinatra – New York, New York; these little town blues, are melting away. I am gonna make a brand new start of it - in old new york. And if I can make it there, I am gonna make it anywhere. It up to you - new york new york~~

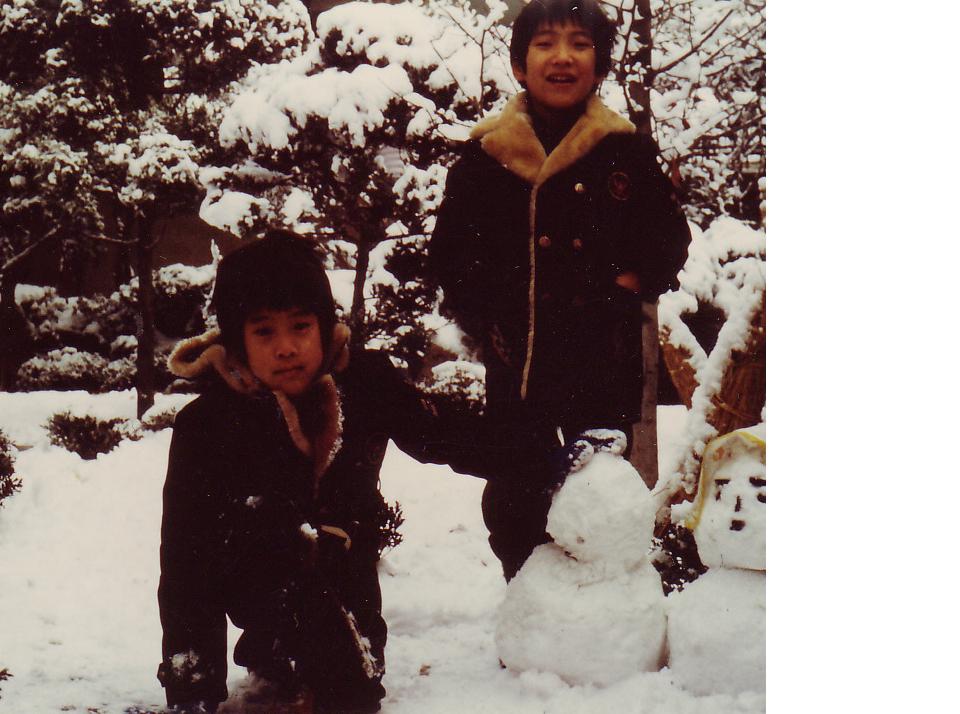

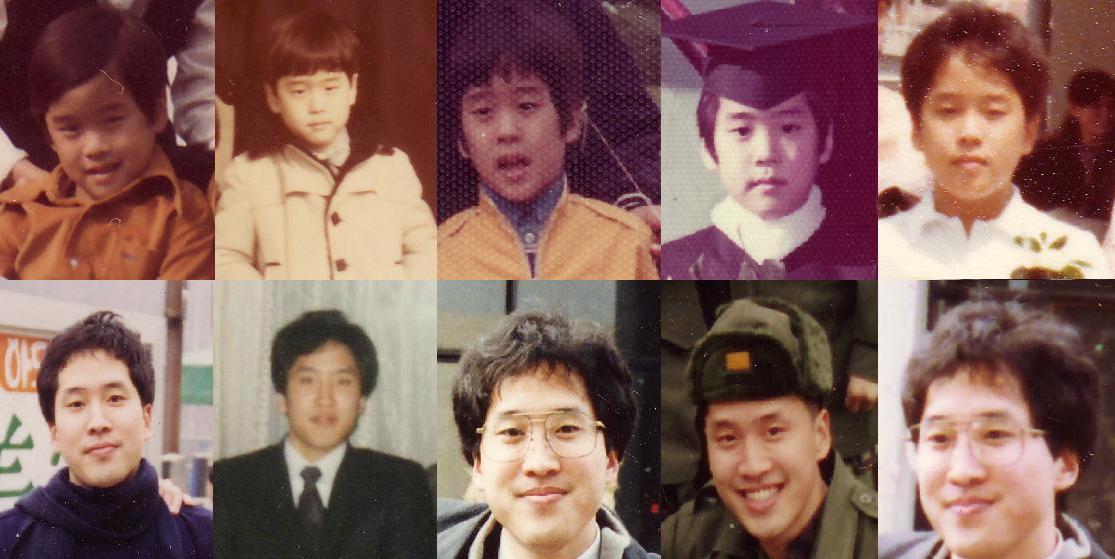

Always it makes me to smile to think of his childhood. We traveled a lot when we were young. We went the beach, valley, and island in the summer and went to snow sled in the winter. When he was young, he had lots of dreams. Professor was not what he wanted to be in the first place. In the sixth grade, he wanted to be a Catholic father. He was a brilliant individual who could not satisfy his hunger for knowledge. He was able to inspire individuals of other professions through conversations revolving around their area of expertise, and always he was able to speak knowledgeably.

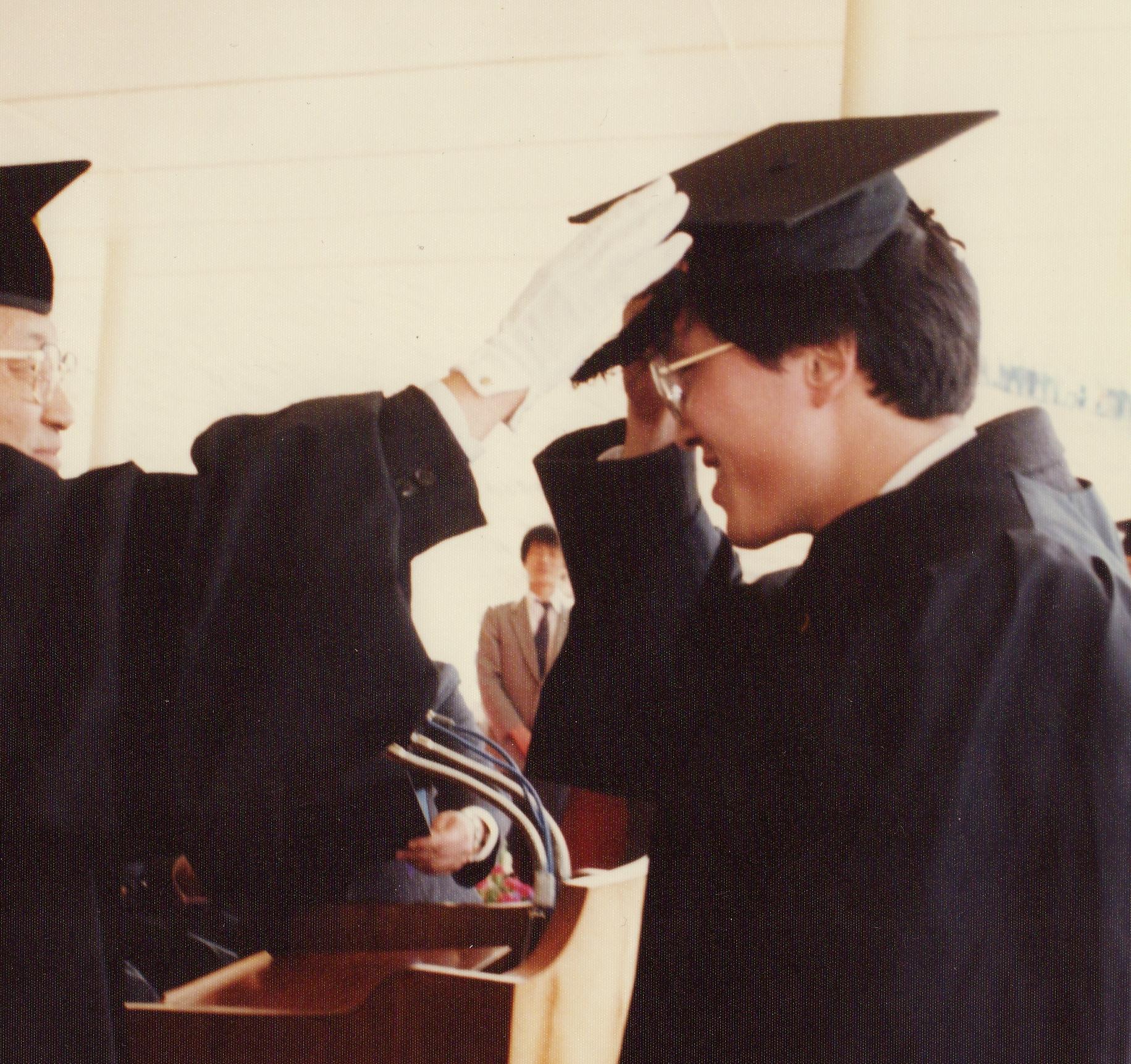

Along with me, he attended public elementary, private middle and high schools. He entered Seoul National University in 1987 and graduated in four years in 1991, with a Bachelor of Economics as Summa Cum Laude. He got the Seoul National University Alumni President Award for graduation with highest honors, 1991 and the Seoul National University President Award for graduation with highest honors at the college of social science. And, he was a research assistant for Professor Un-Chan Chung during 1993-95: "A tract of Financial Reform in Korea" (in Korean); "Central Bank: Theory and Evidence" (in Korean).

Based upon its application and acceptance rates, Seoul National University is considered one of the most competitive universities in South Korea. From 1981 to 1987, more than 80% of the top 0.5% scorers in the annual government-administered scholastic achievement test applied only to SNU, many of them unsuccessfully. The fraction of non-SNU applicants among the top 0.1% scorers was below 5%. No comparable data are available for direct comparison between SNU and non-SNU applicants after 1988, due to an extensive change in South Korea's college entrance system. SNU graduates dominate South Korea's academia, government, politics and business.

Similar to University of Tokyo graduates in Japan, the concentration of SNU graduates in legal, official, and political circles is particularly high. Two-thirds of South Korean judges are SNU graduates, although the country's judicial appointment system is based solely on open competitive examinations. In government, slightly more than half of South Korea's elite career foreign service corps, recruited on the basis of a competitive higher diplomatic service exam, are from SNU. Similarly, among the high-ranking government officials who got recruited an equally competitive higher civil service exam, SNU graduates take up more than 40 percent. On the political side, four out of seven presidential candidates in 2002 were SNU graduates. The school is also often criticized by many South Koreans for being elitist and bureaucratic

The School of Economics at Seoul National University provided well-organized basic economics courses and numerous courses dealing with the multi-faceted aspects of modern economic problems. These traditional topics include the efficient allocation of limited resources, economic growth, equity, stability. Less traditional topics include issues surrounding the environment and technological development. The faculty research areas are diverse and reflect the particular features of the Korean economy. Nevertheless, the faculty members who teach the major areas such as micro and macroeconomics and econometrics are active and strong in research, as their publication records show. The graduates of the division are also very active, in many fields, which include academia, government, financial institutions, research institutions and international organizations.

The graduate program of the School of Economics furnishes students with the means to engage in focused and original academic pursuits, and trains students in the supervision of academic research. The graduate program addresses students who wish to prepare themselves for teaching and research or for responsible positions in government, research organizations, or business enterprises.

The six main fields are: 1. Microeconomics, 2. Macroeconomics, 3. Econometrics, 4. International Economics, 5. Economic History and History of Economic Thoughts, and 6. Applied Economics: Industrial, Labor, Technology, or Development Economics.

.jpg)

After graduation, he had Served in the Korean Army in the fulfillment of mandatory service requirement. Army life presented many difficulties/challenges/opportunities to him. Military service is mentioned as one of the Four Constitutional Duties (along with taxes, education, and labor). The current effective Conscription Law, however, applies only to males although women can volunteer as officers.

Military service varies according to branch: 24 months for the Army and Marine Corps, 26 months for the Navy and 27 months for the Air Force. Recently, however, there has been significant pressure from the public demanding either a shortening of the term or a switch to voluntary military service.

He entered Harvard University and earned his doctoral degree in Economics there in the 1990s.

Harvard University is a private university in Cambridge, Massachusetts, USA. Founded in 1636, Harvard is the oldest institution of higher learning still operating in the United States. It is one of eight schools in the Ivy League.

The institution was named Harvard College on March 13, 1639, after its first principal donor, a young clergyman named John Harvard. A graduate of Emmanuel College, Cambridge in England, John Harvard bequeathed about four hundred books in his will to form the basis of the college library collection, along with half his personal wealth worth several hundred pounds. The earliest known official reference to Harvard as a "university" rather than a "college" occurred in the new Massachusetts Constitution of 1780. In his 1869-1909 tenure as Harvard president, Charles William Eliot radically transformed Harvard into the pattern of the modern research university. Eliot's reforms included elective courses, small classes, and entrance examinations. The Harvard model influenced American education nationally, at both college and secondary levels.

He excelled in his studies and earned scholarships that funded his education at Harvard. He was selected as the POSCO Scholarship for Advanced Studies and Dan Am Scholarship for distinguished student in economics. In addition, he got the Certificate of Distinction in Teaching, Derek Bok Center for outstanding teaching quality in Economics 10. And he was a group leader, supervise six graduate student, Teaching Fellows for Time Series Analysis (graduate) and Capital Market (undergraduate)- Professor James Stock and Professor Nicholas Barberis.

And he also was a Research, Research Assistant: For Professor John Campbell (1997-99, Data Manager for CRSP, COMPUSTAT and TAQ and 1998, NBER working paper 7144, "Dispersion and Volatility in Stock Returns: An Empirical Investigation" )

After receiving his Ph.D degree, he got a teaching job as a faculty member at the University of Alberta. The University of Alberta (U of A) is a public coeducational research university located in Edmonton, Alberta, Canada. Founded in 1908 by Alexander Cameron Rutherford, the first premier of Alberta and Henry Marshall Tory, the first president, the university's current enrolment is over 36,000, placing it among the five largest universities in Canada. The main campus covers 50 city blocks with over 90 buildings directly across the North Saskatchewan River from downtown Edmonton. The U of A has approximately 36,000 students, more than 6,000 of them in graduate studies, while about 2,000 are international students from 110 countries. The university has 3,353 academic staff along with about 6,000 support and trust staff.

The university's professors have won more 3M Teaching Fellowships (Canada's top award for undergraduate teaching excellence) than any other Canadian university, 26 awards since 1986. The university offers post-secondary education in about 200 undergraduate and 170 graduate programs. Tuition and fees for both fall and winter semesters are slightly more than $5,000 for a typical undergraduate student, although they vary widely by program. The University of Alberta switched from a 9-point grading scale to the more common 4-point grading scale in September 2003.

He has authored a number of academic journal articles. His famous academic journal article : An Analysis of the Impact of Trades on Stock Returns Using Money Flow Data, manuscript (2000). This paper analyzes the impact of trades on stock returns. Existing work on the impact of trades has been conducted at the transaction level and fails to identify the existence of the temporary price impact. Using lower frequency data and longer return horizons, I reach a different conclusion: there is a considerable temporary price impact of trades. If the impact of trades contains a temporary component, trading activity today will predict future returns. I find this characteristic in residual money flow data, which measures the above-average net buy activity in the market for a given level of return. High residual money flow predicts lower future returns at a relatively long horizon.

The temporary price impact is greater for smaller firms. Understanding Trading Volume around Earnings-Announcement, in process (2000), co-author: Wonseok Choi (Harvard University) In this paper, we measure the dispersion of investors' expectations using t54ading volume data and analyze the effect of the dispersion measure on the pattern of drift after earnings-announcement. We find that firms with high abnormal volume exhibit larger post-announcement drift than firms with low abnormal volume.

Cross-Sectional Determinants of Earnings-Announcement Drift, manuscript (1999, under revision) This paper analyzes the cross-sectional determinants of an earnings-announcement drift. I find that the profits of earnings, announcement based investment strategy are smaller for firms with many analysts and a larger institutional ownership holding. I also investigate the behavior of investors around earnings-announcement using money flow data that I create from TAQ data set.

Behavioral Explanation of Earnings-Announcement Drift: An Empirical Test, manuscript (1999), co-author: Dmitry Rozhkov (IMF). This paper tests whether the stock price response to earnings-announcement is path-dependent. Consistent with the prediction of Barberis, Shleifer and Vishny's behavioral model, the response is smaller after investors experience the shock of the same sign in a series.

Financial economics is primarily concerned with building models to derive testable or policy implications from acceptable assumptions. Some fundamental ideas in financial economics are portfolio theory, the Capital Asset Pricing Model. Portfolio theory studies how investors should balance risk and return when investing in many assets or securities. The Capital Asset Pricing Model describes how markets should set the prices of assets in relation to how risky they are. The Modigliani-Miller Theorem describes conditions under which corporate financing decisions are irrelevant for value, and acts as a benchmark for evaluating the effects of factors outside the model that do affect value.

A common assumption is that financial decision makers act rationally. However, recently, researchers in experimental economics and experimental finance have challenged this assumption empirically. They are also challenged - theoretically - by behavioral finance, a discipline primarily concerned with the limits to rationality of economic agents.

Other common assumptions include market prices following a random walk, or asset returns being normally distributed. Empirical evidence suggests that these assumptions may not hold, and in practice, traders and analysts, and particularly risk managers, frequently modify the "standard models".While in economics models are mainly employed to judge social welfare, financial economists are more concerned with empirical predictions.

During the classical period, economics had a close link with psychology. For example, Adam Smith wrote The Theory of Moral Sentiments, an important text describing psychological principles of individual behavior; and Jeremy Bentham wrote extensively on the psychological underpinnings of utility. Economists began to distance themselves from psychology during the development of neo-classical economics as they sought to reshape the discipline as a natural science, with explanations of economic behavior deduced from assumptions about the nature of economic agents. The concept of homo economicus was developed, and the psychology of this entity was fundamentally rational. However, this introduced serious errors.

Psychological explanations continued to inform the analysis of many important figures in the development of neo-classical economics such as Francis Edgeworth, Vilfredo Pareto, Irving Fisher and John Maynard Keynes.

Although psychology had nearly disappeared from economic discussions, during the 20th century there appeared an economic psychology in works of the French Gabriel Tarde the American George Katona and the Hungarian Laszlo Garai Expected utility and discounted utility models began to gain wide acceptance, generating testable hypotheses about decision making under uncertainty and intertemporal consumption respectively. Soon a number of observed and repeatable anomalies challenged those hypotheses.

Furthermore, during the 1960s cognitive psychology had begun to shed more light on the brain as an information processing device (in contrast to behaviorist models). Psychologists in this field such as Ward Edwards, Amos Tversky and Daniel Kahneman began to compare their cognitive models of decision making under risk and uncertainty to economic models of rational behavior. In mathematical psychology, there is a longstanding interest in the transitivity of preference and what kind of measurement scale utility constitutes (Luce, 2000).

An important paper in the development of the behavioral economics and finance fields was written by Kahneman and Tversky in 1979. This paper, 'Prospect theory: An Analysis of Decision Under Risk', used cognitive psychological techniques to explain a number of documented divergences of economic decision making from neo-classical theory (Kahneman, 2003). However, 'Theory of Crime' written by Nobel Laureate Gary Becker in 1967 was a seminal work that factored in psychological elements into economic decision making; Becker, however, insisted on maintaining strict consistency of preferences.

In tracing the history of behavioral economics, reference should be made to the theory of Bounded Rationality by Nobel Laureate Herbert Simon who explained how people irrationally tend to be satisfied, instead of maximizing utility, as generally assumed. Other prominent forerunners of modern behavioral economics include Maurice Allais, whose "Allais Paradox" represented a crucial early challenge to expected utility.

Over time many other psychological effects have been incorporated into behavioral economics, such as overconfidence, projection bias, and the effects of limited attention. Further milestones in the development of the field include a well attended and diverse conference at the University of Chicago, a special 1997 edition of the Quarterly Journal of Economics ('In Memory of Amos Tversky') devoted to the topic of behavioral economics and the award of the Nobel prize to Daniel Kahneman in 2002 "for having integrated insights from psychological research into economic science, especially concerning human judgment and decision-making under uncertainty".

Prospect theory is an example of generalized expected utility theory. Although not commonly included in discussions of the field of behavioral economics, generalized expected utility theory is similarly motivated by concerns about the descriptive inaccuracy of expected utility theory.

Behavioral economics has also been applied to problems of intertemporal choice. The most prominent idea is that of hyperbolic discounting, proposed by George Ainslie (1975) and developed by David Laibson, Ted O'Donoghue, and Matthew Rabin, in which a high rate of discount is used between the present and the near future, and a lower rate between the near future and the far future. This pattern of discounting is dynamically inconsistent (or time-inconsistent), and therefore inconsistent with some models of rational choice, since the rate of discount between time t and t+1 will be low at time t-1, when t is the near future, but high at time t when t is the present and time t+1 the near future. As part of the discussion of hypberbolic discounting, has been animal and human work on Melioration theory and Matching Law of Richard Herrnstein.

They suggest that behavior is not based on expected utility rather it is based on previous reinforcement experience, verbal framing, direct-acting and verbally-governed contingencies. Thus, financial and utilitarian choice making becomes a deterministic process amendable to empirical modelling, investigation, understanding and influence.

Other branches of behavioral economics represent less of a challenge to neoclassical utility theory, enriching the model of the utility function without implying inconsistency in preferences. A great deal of work on "fairness" and "reciprocal altruism" by scholars such as Ernst Fehr, Armin Falk, and Matthew Rabin has weakened the neoclassical assumption of "perfect selfishness." This work is particularly applicable to wage setting in labor markets. Work on "intrinsic motivation" by Gneezy and Rustichini and on "identity" by Akerlof and Kranton allow agents to derive utility from meeting personal and social norms in addition to consumption.